How to calculate lending capacity

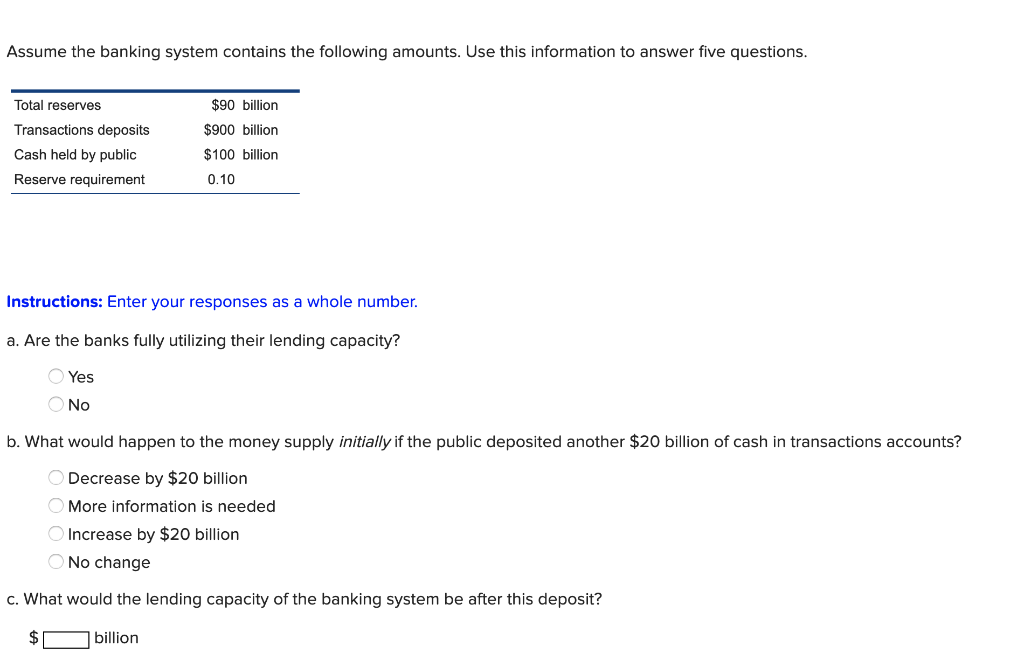

EBITDA and Debt Capacity. Money multiplier 1r or 101 10.

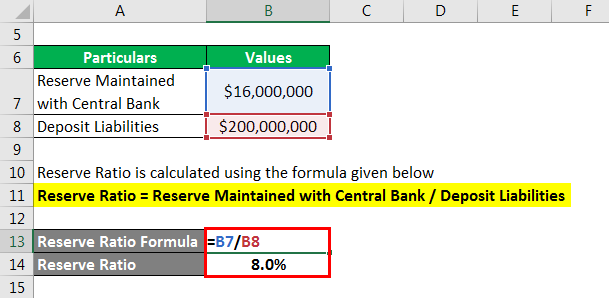

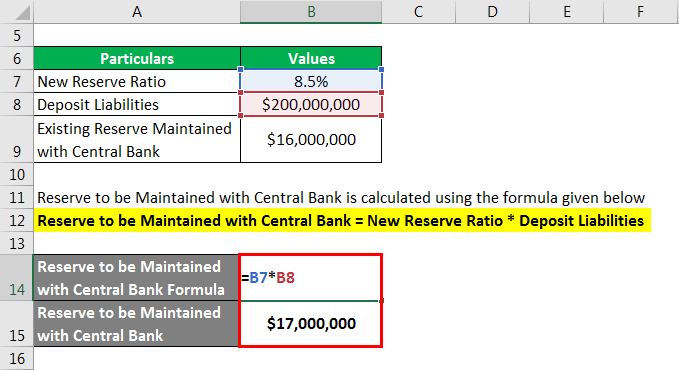

Reserve Ratio Formula Calculator Example With Excel Template

If Start-of-Period is selected then the first payment will be due on the loan date.

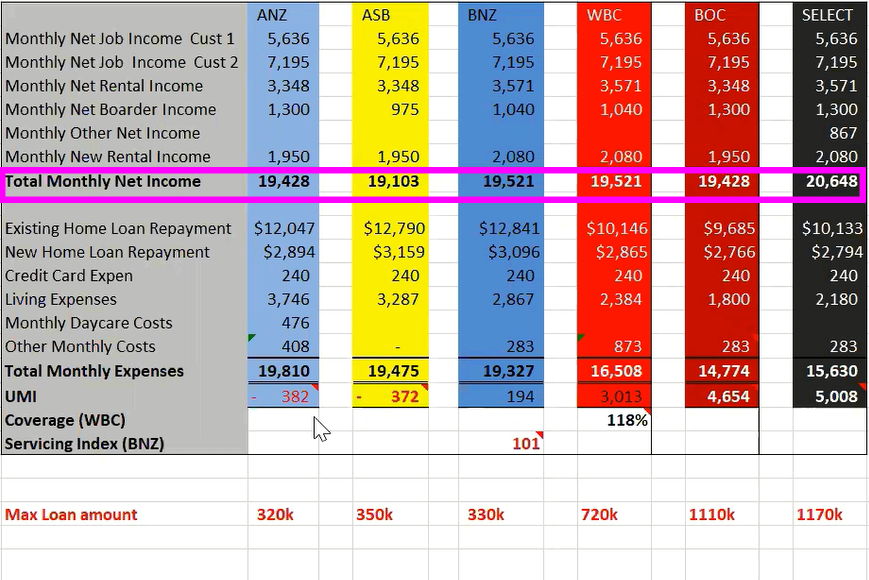

. Borrowing Power Calculator Calculator. Our bank as it is right now it has a reserve ratio of 71. Essentially your borrowing capacityis determined by figuring out the difference between your net income what you get paid after taxes minus your total monthly expenses.

So as long as no more than 71 of these people-- some of. Unused lending capacity Formula. The calculators max loan amount is NOK 15 000 000.

View your borrowing capacity and estimated home loan repayments. The banking systems lending capacity is equal to. When Do You Need the Loan.

Choose Your Line of Business Choose Your Industry Annual Sales Volume Years In Business Business HQ Zip Code Your Information Your Name Title Company Name. If the MPC of the economy is 085 and the government decreases taxes by 100 million what is the impact on. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home loan.

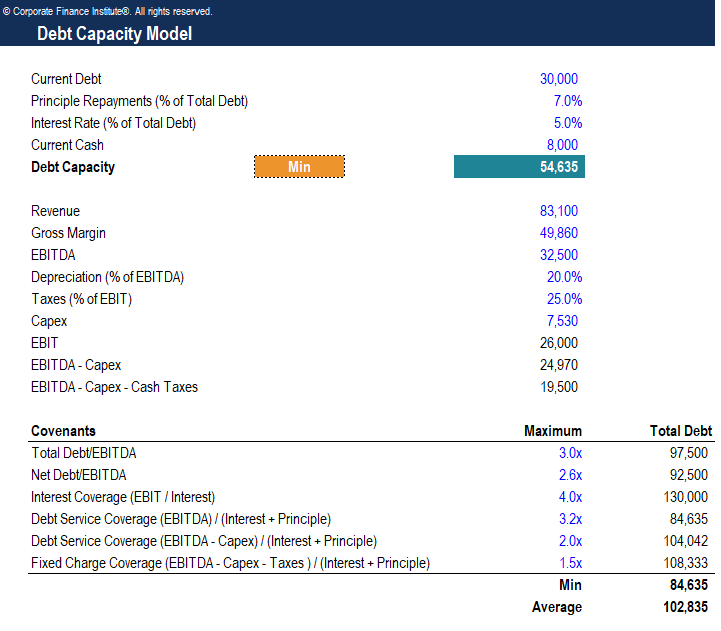

Estimate how much you can borrow for your home loan using our borrowing power calculator. Assessing Debt Capacity The two main measures to assess a companys debt capacity are its balance sheet and cash flow measures. Money multiplier Excess reserves.

Calculating your borrowing capacity implies collateral or security loan as well. International Customers can call 675 305 7842. Lenders generally follow a basic formula to calculate your borrowing capacity.

Complete the forms below to get view your estimated borrowing capacity. Your Business Information Purpose of the Loan How Much Do You Want To Borrow. With the default selection End-of-Period the first payment will be due one month after the loan is made.

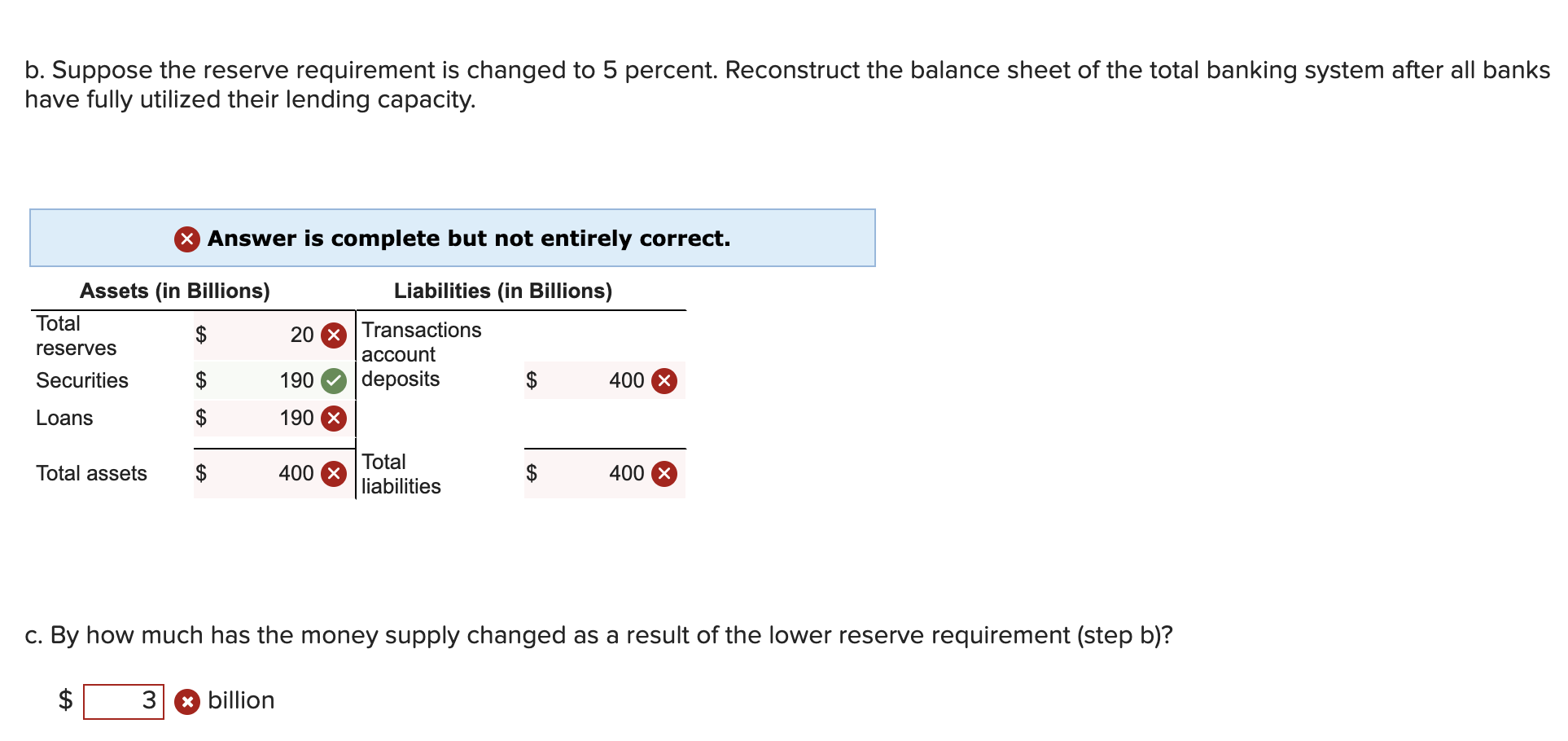

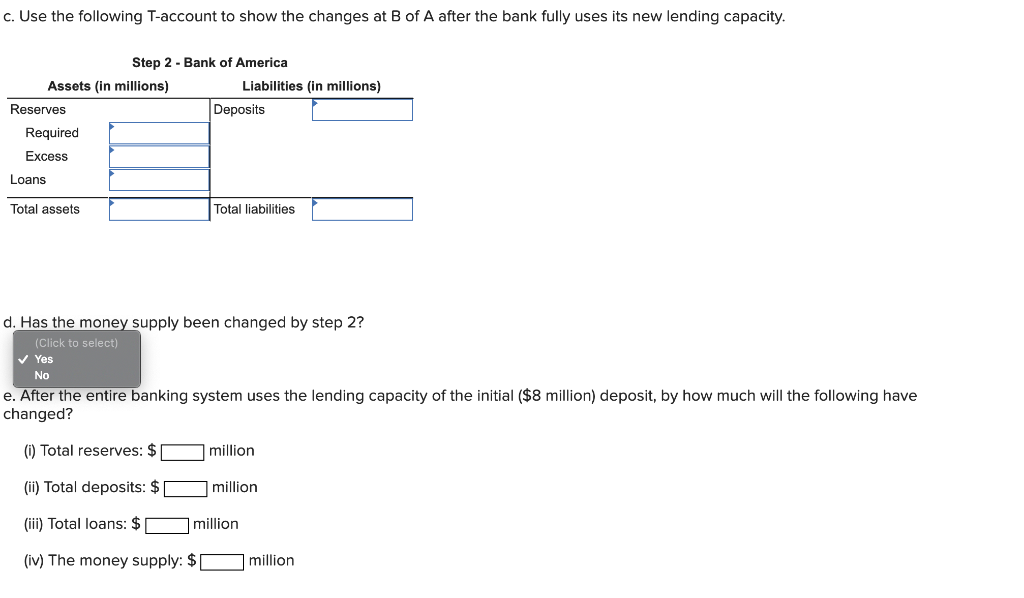

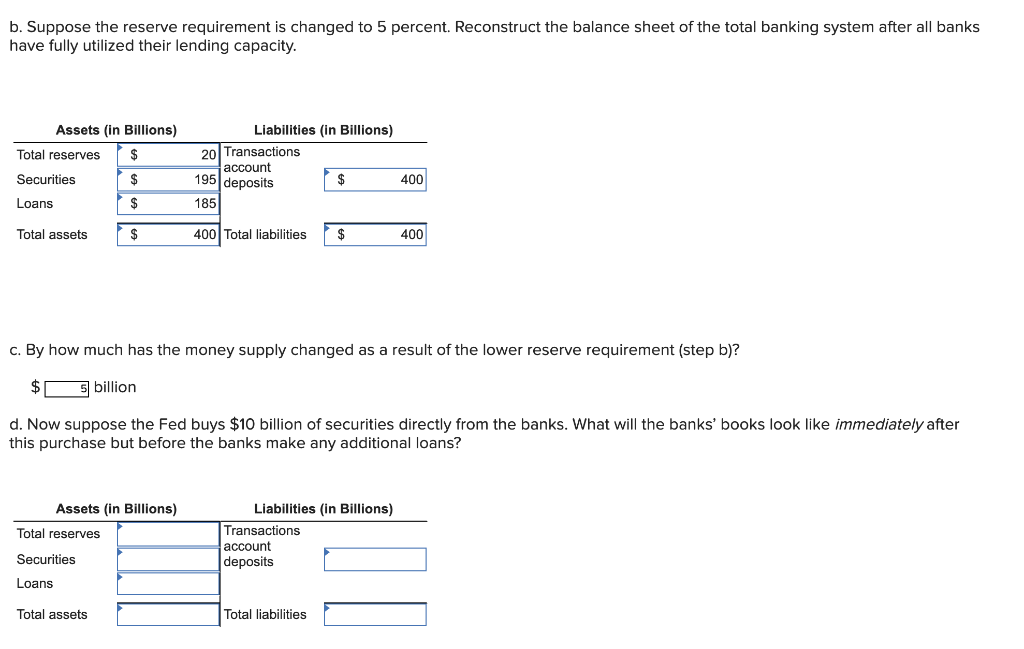

While there is a standard formula lenders follow lenders may assess your income or expenses differently. APPLY FOR LOAN APPLY FOR LOAN. Based on the simple money multiplier calculated calculate the total change in the money supply available.

Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. Annual income monthly expenses and loan details. How to use this formula to not go bankrupt.

So essentially this reserve ratio is what the regulators think that a bank needs to maintain in order to be liquid. Your borrowing capacity is good. By shopping around or approaching a mortgage broker you may find you improve your borrowing capacity.

The term duration of the loan is expressed as a number of months. Different lenders require different lending criteria. Compare home buying options today.

Ive noticed that it seems to round down so if the calculation comes out to 435 it will round down to 43. Your borrowing capacity is the maximum amount lenders will loan to you. For that reason care must be taken and see what assets you can lose in.

So the bank has to stay liquid. Please send us an application and. Buying or investing in a new property we have a variety of tools and calculators to.

Excess reserves x money multiplier. If youre not sure just put an estimate. 1 required reserve ratio.

The Payment Method determines when the first payment is due. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. For example if you cannot meet the terms described in the loan you are at risk of losing significant assets.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. What would happen to money supply initially if the public deposited 30 billion cash in transaction accounts transaction deposit 800 billion No change. Our Maximum Borrowing Capacity Calculator is mirrored to Mortgage Insurers parameters making it one of the most accurate estimators in the market today.

By analyzing key metrics from the balance sheet and cash flow statements investment bankers determine the amount of sustainable debt a company can handle in an MA transaction. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. There are three parts to this calculator.

The Loan Size calculation is 05 x total dev x 1 trade efficiency from diplo tech I have tested this out on a variety of nations and different ages and it seems to check out. View full document See Page 1 Available lending capacity excess reserves X money multiplier Increasing the reserve requirement means o Amount of excess reserves decreases o Money multiplier decreases o Avail lending shrinks Decrease reserve requirement. 60 months 5 years.

Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus While lenders all adopt this general framework there are differences in how they weigh and assess each dataset outlined below. Total reserves - required reserves.

Solved I Need The Correct Answers And Explanations Of How To Chegg Com

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

How Much Can I Borrow Home Loan Calculator

Solved Please Give Me An Explanation Of The Calculations Chegg Com

Solved I Need The Answers And Explanations Of The Chegg Com

Lvr Borrowing Capacity Calculator Interest Co Nz

Reserve Ratio Formula Calculator Example With Excel Template

Money Creation Yellow Page Worksheet

Solved Can You Give The Explanations Of The Calculations Chegg Com

Money Banking And Financial Institutions Ppt Video Online Download

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

Reserve Ratio Definition

Understanding Coverage Ratio A Measure Of The Ability To Repay Loans Farmdoc Daily

Excel Formula Calculate Original Loan Amount Exceljet

Debt Capacity Model Template Download Free Excel Template

How Much Mortgage Can I Afford Increase Borrowing Power

Understanding Coverage Ratio A Measure Of The Ability To Repay Loans Farmdoc Daily